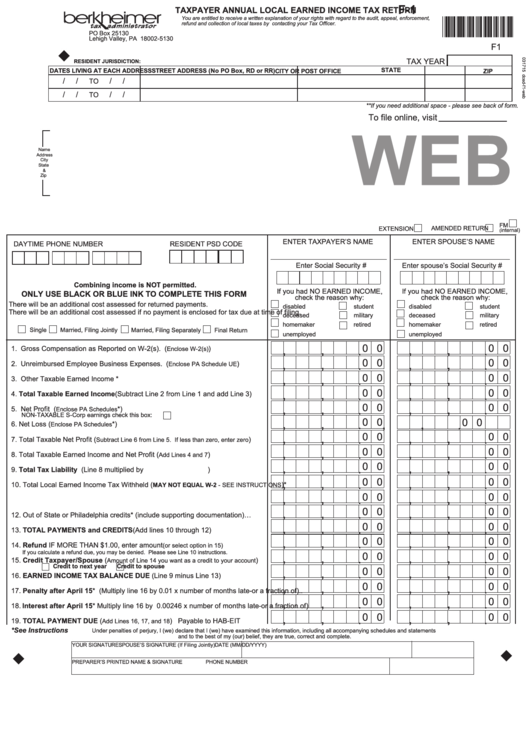

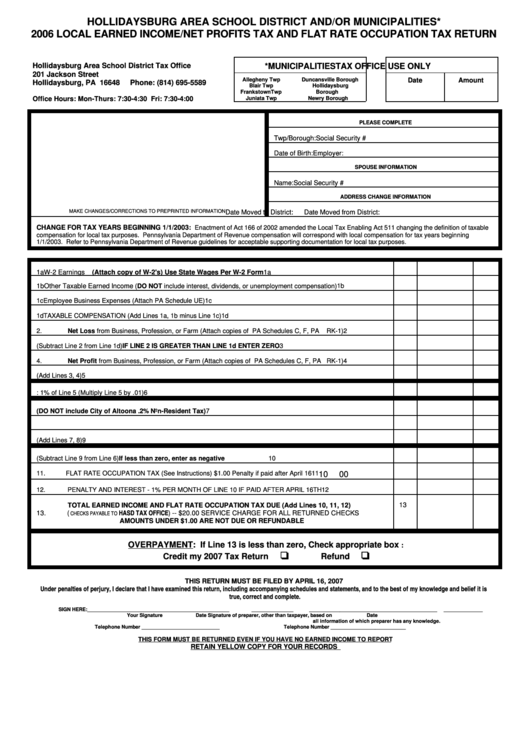

Subtract the nontaxable biweekly Federal Employees Health Benefits (FEHB) payment from the gross biweekly wages.No action on the part of the employee or the personnel office is necessary. The resident income tax rate for the city of Philadelphia, Pennsylvania, has changed from 3.8398 percent to 3.79 percent, and the nonresident income tax rate has changed from 3.4481 percent to 3.44 percent.Īll other information remains the same. The nonresident income tax rate for the city of Reading, Pennsylvania, has changed from 1.3 percent to 1.0 percent. More Informationįor more information, please visit the Finance Department.TAXES 22-25, Pennsylvania (Local) Income Tax Withholding If you have any questions concerning the earned income tax, please contact:įorms may also be downloaded from their website. Failure to receive forms does not excuse residents from the obligation to file a timely and correct return. Please remember that it is the tax payer's responsibility to make sure these procedures are followed. Interest and penalty, at the rate of 1% per month, is charged for failure to file the required quarterly return. Payment of the entire amount due at year's end is not permitted. Quarterly returns must be filed by those residents who do not have a 1% earned income tax withheld at their place of employment. The Earned Income Office has no record of your employment status.You resided in Upper Moreland Township for less than the entire year.You are a student, or you are retired, and working part time.Total earnings are less than $4,000 and no tax is due.Philadelphia City Wage Tax has been withheld and no tax is due.The tax has been withheld at place of employment and no tax is due.The tax is imposed an all earnings from employment, whether this is reported on the W-2 and/or business schedules even if:

Residents must be registered with the Earned Income Tax Office and registration can be done by phone, mail or in person.

It is also levied on all non-residents working in Upper Moreland. The 1% earned income tax is levied upon all Township residents, no matter where employed. Berkheimer website or contact the main office toll free at 86 or 61. To register, ask questions, or obtain forms, contact: has been appointed Earned Income Tax Collector.

0 kommentar(er)

0 kommentar(er)